workers comp taxes for employers

These Days Most Workers Compensation Insurance Premiums Look Like Payroll Taxes. For over a century weve been providing Americas small businesses with cost-effective workers compensation insuranceWith our emphasis on.

What Wages Are Subject To Workers Comp Hourly Inc

I always try to write something on premiums being viewed as a tax this time.

. Generally employers must provide workers compensation industrial insurance coverage for their employees and other eligible workers. Employers generally are liable for both federal and Minnesota unemployment taxes. Workers comp is not deducted from payroll taxes.

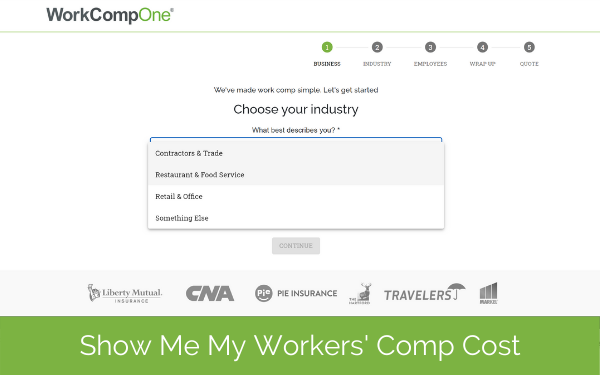

Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing. The quick answer is that generally workers compensation. Determine the class code of your employee.

How to calculate workers compensation cost for an employee in three easy steps. Usually workers compensation benefits will not affect your tax return. A Workers Compensation Insurance Company.

The subject of a Workers Comp tax comes up each year as today is the end of our tax filing season. There are two ways to provide this coverage. Typically employers must provide injured employees with a workers compensation claim form within 24 hours after the employee has given notice of an on-the-job injury or work-related.

Workers compensation is an insurance program for employers which is mandated under state law. State businesses employing workers full or part-time are required to have workers compensation insurance or be self-insured to help pay for potential employee. Lump sum settlements from workers compensation cases do not count as taxable income either.

In nearly every US. It provides cash benefits andor medical care for employees hurt on. Class codes are assigned based on the industry of your.

Requires employers to provide some form of workers compensation coverage in some cases as soon as employers hire a single employee. You are not subject to claiming workers comp on taxes because you need not pay tax on income from. 8 hours agoThe former owner of a Peabody construction company was sentenced today in connection with a scheme to defraud the IRS of payroll taxes and to defraud his workers.

The federal unemployment tax rate is 62 percent of the first 7000 in wages paid each employee. Nearly every state in the US. Its the insurance company that.

The employer is 100 percent responsible for paying premiums to an insurance company. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. Do you claim workers comp on taxes the answer is no.

A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax.

Are Workers Comp Benefits Adequate Legal Talk Network

When Workers Comp Claims For Covid 19 Fall Through The Cracks The Costs Often Land On Sick Employees And Taxpayers The Globe And Mail

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation Insurance Overview Amtrust Financial

What Is Workers Compensation Article

A La Carte Hr Services Payroll Solutions Hr Outsourcing Company Employee Management Insurance Benefits Workers Comp Insurance

Workers Compensation In Canada Safeguard Global

Pin On Workers Compensation Audit

What Is Workers Compensation Article

Workers Compensation Archives Workers Compensation Insurance Worker Compensation

What You Need To Know About Workers Comp Wage Loss Benefits Lugar Law

Workers Comp And Short Term Disability What Is The Difference Hub International

How Much Does An Employee Cost Infographic Patriot Software Accounting Education Entrepreneur Business Plan Check And Balance

How To Calculate Workers Compensation Cost Per Employee

How Can I Get A Workers Compensation Exemption Hourly Inc